Company Profile

The banking sector is one of the industries with the most transactional activity. As the number of banking customers continues to rise, it is not uncommon for customers to repeatedly request the same information. Of course, this causes the banks to become extremely overburdened. As a result, BNI innovated by incorporating AI conversation technology via text and voice to assist with customer service.

Issue

- Prior to implementing the Lenna AI solution, banks were inundated with customer inquiries. In addition, customers often ask the same questions. As a result, customer service must respond to questions or requests from customers on a regular basis. This, of course, is neither effective nor efficient.

- Before using the mobile app, BNI’s active transaction activities were quite systematic because customers could only make transactions at certain locations such as ATMs and banks.

- Banks must provide a high level of service to customers so that services can function properly. Of course, this will result in higher operating costs.

Business Needs

- Improving customer service performance in order to provide better services to customers.

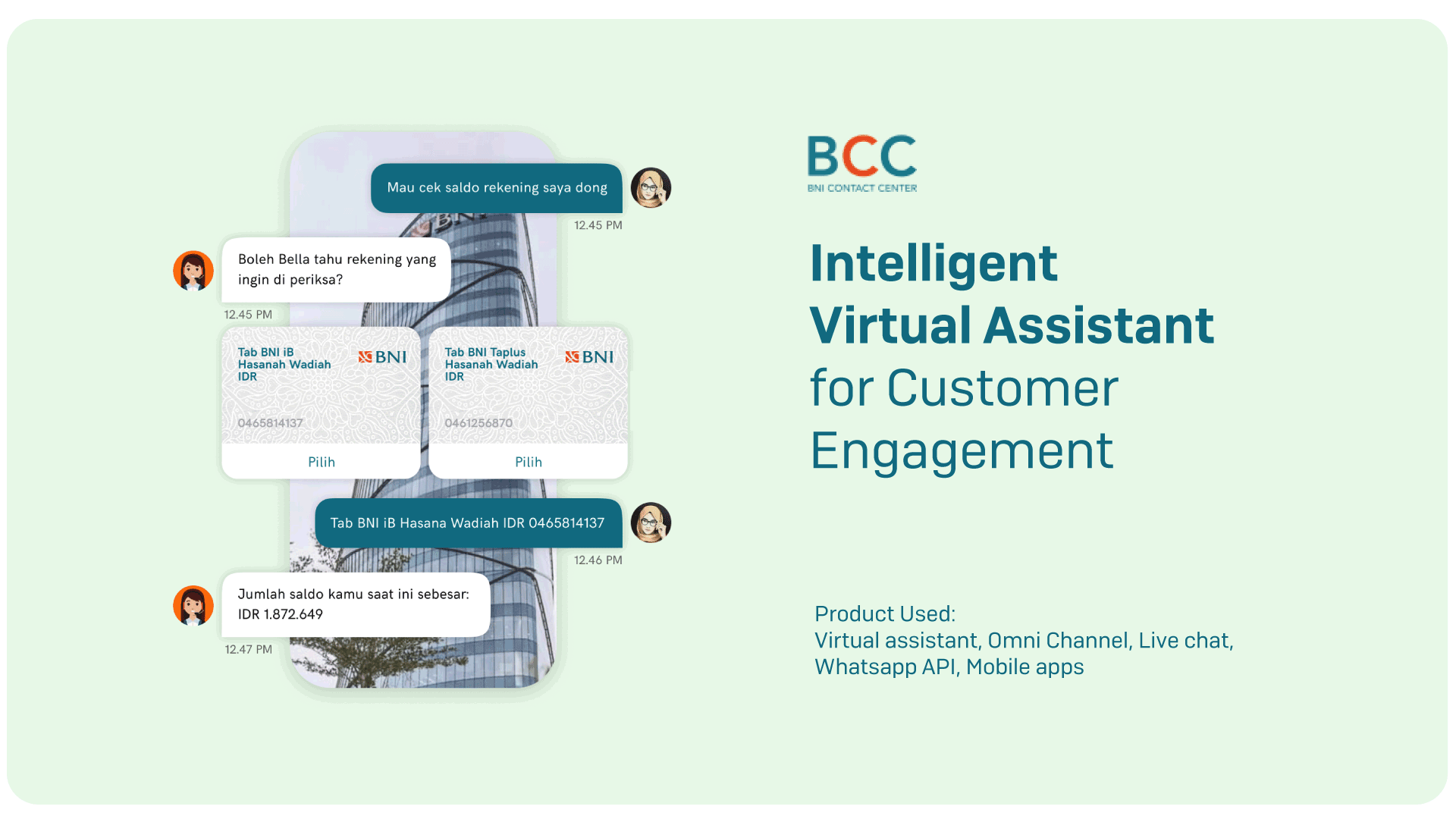

- Make transaction activities like balance checks, account transfers, and mutation checks easier for customers.

- Facilitate the provision of information to customers by banks.

- Customers will have more access to banking information, such as product promotions, branch locations, interest rates, etc.

- Savings on expenses

Business Impact

- The number of product questions decreased after Lenna AI’s solution was implemented because of bot had already answered them.

- Implying that BNI’s smart assistants can serve thousands of customers quickly.

- As just a result, agents are free to focus on the most important questions rather than answering the same repetitively.

- The presence of a Smart Virtual Assistant on BNI Mobile has increased the number of active transactions. This is due to the fact that a trusted virtual assistant can conduct banking transactions in a secure manner, wherever and whenever they want, using the voice command feature.

- Virtual assistants are more practical and efficient when it comes to assisting clients and reducing operational costs.

- With the Lenna Omnichannel, all chats can be accessed from a single platform.